Happy 2022 or is it 2020 two? Once again we start the year with an abundant amount of buyers, mixing with scarce listings driving prices sky high. Deja Vu? Interest rates appear to be on the upward trend in the future as the economy continues to perform well and inflation continues to remain above the Bank of Canada target. With the currently lower interest rates, lack of inventory and consumer confidence we have yet again seen homes sell for all-time record setting highs. Buyers continue the move up trend: Buyers who desire more space for their future needs. What’s the right thing to do? Should you buy or sell first? It really depends on your individual situation and your tolerance for risk. We’d be happy to listen to you tell us about your needs and talk through your options and help you decide if you should buy or sell first!

Here are some Key Take-aways from the RE/MAX 2022 CANADIAN HOUSING MARKET OUTLOOK report:

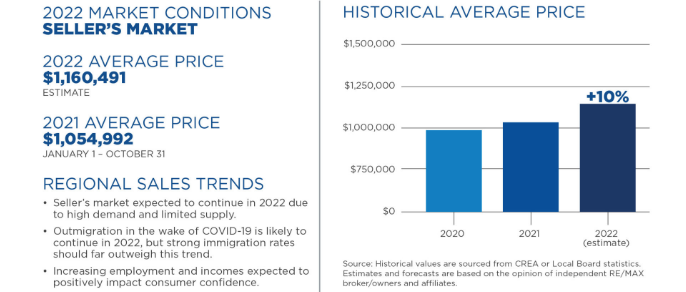

RE/MAX Canada expects average residential prices to rise by 9.2 per cent in 2022 Canadians continue to be confident in the housing market, with the inter-provincial relocation trend likely to remain strong in 2022

-

95 per cent of regions (36 out of 38) surveyed are likely to remain seller’s markets in 2022

RE/MAX Canada is anticipating steady price growth in 2022, with inter-provincial migration continuing to be a key driver of housing activity in many regions, based on surveys of RE/MAX brokers and agents, as reflected in RE/MAX’s 2022 Canadian Housing Market Outlook Report. The ongoing housing supply shortage is likely to continue, putting upward pressure on prices. As a result of these factors, RE/MAX Canada estimates a 9.2 per cent increase in average residential sales prices across the country*. “Based on feedback from our brokers and agents, the inter-provincial relocation trend that we began to see in the summer of 2020 still remains very strong and is expected to continue into 2022,” says Christopher Alexander, President, RE/MAX Canada. “Less-dense cities and neighbourhoods offer buyers the prospect of greater affordability, along with liveability factors such as more space. In order for these regions to retain these appealing qualities and their relative market balance, housing supply needs to be added. Without more homes and in the face of rising demand, there’s potential for conditions in these regions to shift further.”

-

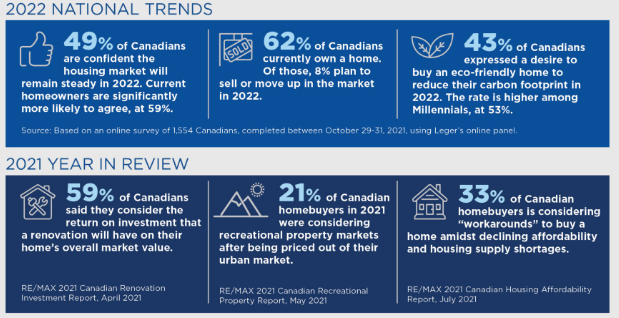

26 per cent of Canadians have the desire to purchase a home while mortgage rates remain low

-

62 per cent of Canadians currently own a home. This is higher among those ages 35+ (70 per cent) compared with Millennials, ages 18-34 (42 per cent)

-

The majority of Canadians (72 per cent) said rising home prices did not impact their purchasing decisions in 2021.

If you're thinking of making a move in 2022 reach out to us today! It's never too early to get started.

.png)